Financials

CONDENSED INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 30 JUNE 2025 AND RELATED ANNOUNCEMENT

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Consolidated Statement of Comprehensive Income

Condensed Interim Statements of Financial Position

Review of performance of the Group

Financial Performance

Overview: Slower palm production growth and the growing domestic palm oil usage for biodiesel mandate in Indonesia continued to support domestic crude palm oil (CPO) prices. In line with the higher commodity prices, the Group delivered an improved set of results in 1H2025 with higher revenue and profit growth.Net profit after tax came in higher at Rp764 billion in 1H2025, increasing 21% over the same period last year. The improved profitability was mainly due to higher gross profit from the Plantation Division. This was partly offset by lower foreign exchange gain, higher share of JV losses and loss arising from changes in fair value of biological assets.

Segment Overview: The Plantation Division recorded 2% and 19% increase in fresh fruit bunches (FFB) nucleus production and purchases of FFB from external parties in 1H2025. In line with this, CPO production increased 7% to 326,000 tonnes. The Division’s revenue rose by 32% in 1H2025 mainly due to higher selling prices and sales volume of palm products. As a results, this Division reported higher operating profit in 1H2025, increasing 39% over the same period last year.

The EOF Division’s revenue increased 19% in 1H2025, driven mainly by higher sales selling prices. However, operating profit declined 10% due to higher purchase costs of CPO.

Revenue: The Group’s consolidated revenue (after elimination of inter-segment sales) rose 33% to Rp9,393 billion in 1H2025. The increase was mainly due to higher selling prices of palm products and edible oils and fats products, as well as higher volume of palm products.

Cost of sales: Higher cost of sales was mainly due to higher purchases of FFB from external parties and higher purchase costs of raw materials (i.e. CPO) by the EOF Division.

Gross profit: The Group’s 1H2025 gross profit increased 43% to Rp2,235 billion mainly contributed by Plantation Division on higher selling prices and sales volume of palm products.

Foreign Exchange Gain: The foreign currency gain was mainly arising from the translation of US dollardenominated cash due to the weakening of Indonesian Rupiah against US Dollar in 1H2025 (i.e. Rp16,233/US$ as of 30 June 2025 versus Rp16,162/US$ as of 31 December 2024) and in 1H2024 (i.e. Rp16,421/US$ as of 30 June 2024 versus Rp15,416/US$ as of 31 December 2023).

Other Operating Expenses: Higher other operating expenses in 1H2025 was mainly due to higher provision for plasma receivables.

Share of Results of Joint Ventures (JVs): The Group recognised higher JV losses of Rp224 billion in 1H2025 compared to Rp83 billion in 1H2024. This was mainly due to lower sales volume of raw sugar, higher loss arising from changes in fair value of biological assets and higher financial expenses.

Gain/(loss) arising from Changes in Fair Values of Biological Assets: In 1H2025, the Group reported a loss of Rp183 billion from changes in fair value of biological assets mainly due to lower FFB production and prices. The gain of Rp91 billion in 1H2024 was mainly due to higher FFB prices.

Profit from Operations: 1H2025 profit from operations increased 13% to Rp1,218 billion mainly due to higher gross profit. This was partly offset by lower foreign exchange gain, higher share of JV losses and loss arising from changes in fair value of biological assets.

Finance Income: Higher finance income in 1H2025 was mainly due to higher cash position.

Net Profit After Tax (NPAT): The Group reported higher NPAT of Rp764 billion in 1H2025, increasing 21% over the same period last year. This was mainly due to higher profit from operations as explained above.

Attributable Profit to the Owners of the Company:1H2025 attributable profit came in 13% higher than the same period last year.

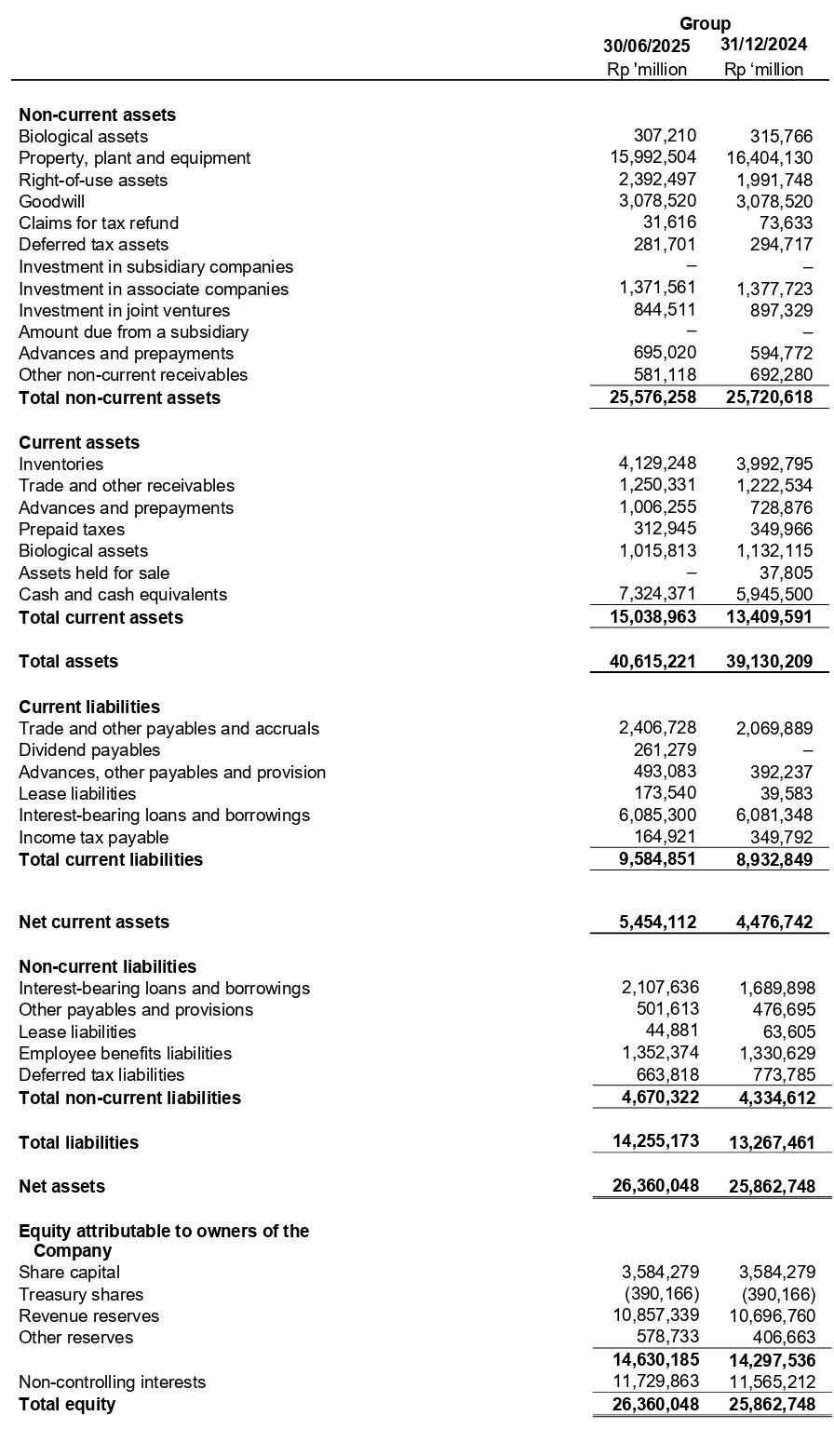

Review of Financial PositionAs at 30 June 2025, the Group reported total non-current assets of Rp25.6 trillion compared to Rp25.7 trillion as at 31 December 2024. The decrease was mainly due to the depreciation of property, plant and equipment and lower plasma receivables. This was partly offset by higher advances for asset purchases and higher right-of-use assets relating to a renewal of land lease for a refinery.

The Group’s total current assets were Rp15.0 trillion as at 30 June 2025 compared to Rp13.4 trillion as at 31 December 2024. The increase was mainly due to higher cash levels, higher inventories relating to sugar and fertiliser, and higher advances for raw material purchases and prepayment of expenses.

As at 30 June 2025, the Group’s total liabilities increased 7% to Rp14.3 trillion mainly due to higher trade and other payables, dividend payable and interest-bearing loans and borrowings loans. This was partly offset by lower income tax payables and deferred tax liabilities.

As of 30 June 2025, the Group recorded net current assets of Rp5.5 trillion compared to Rp4.5 trillion at the last year-end. The Group’s financial position continued to strengthen with higher cash levels. The Group’s net debt to total equity ratio improved, decreasing from 0.07 times in the last year-end to 0.03 times as at 30 June 2025.

Review of Cash FlowsThe Group reported higher net operating cash flows of Rp1,894 billion in 1H2025 compared to Rp895 billion in 1H2024 mainly due to improved operating results.

The Group recorded Rp767 billion of investing activities in 1H2025 compared to Rp405 billion in 1H2024. This was mainly due to additions of right-of-use assets relating to a renewal of land lease for a refinery, and higher advances for projects and fixed assets.

In terms of financing activities, the Group recorded net cash inflow of Rp244 billion in 1H2025, compared to a net cash usage of Rp226 billion in 1H2024. This was mainly due to a drawdown of loan facilities for capital expenditures purposes.

The Group’s cash level increased from Rp5,946 billion as at 31 December 2024 to Rp7,324 billion as at 30 June 2025 largely due to positive operating free cash flows.

Commentary

Commodity prices are expected to remain highly volatile, driven by uncertainties surrounding weather conditions and geopolitical conflicts. Global demand growth is likely to remain subdued due to challenging macroeconomic factors.

Despite the outlook, the Plantation Division will continue to focus on targeted action plans, including improving operational results, strengthening cost controls, driving innovations that elevate plantation productivity, and prioritising capital investments in critical areas.

Upon completion of the expansion of our Tanjong Priok refinery in the second half of 2025, the expansion will increase the total CPO refining capacity from 1.7 million tonnes to 2.2 million tonnes annually. With higher refining capacity, the EOF Division will focus on expanding sales volumes through competitive pricing strategies and enhanced distribution, ensuring ample availability to meet Indonesia’s population and per capita income growth.