106.

INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

N

O

T

E

S

T

O

T

H

E

F

I

N

A

N

C

I

AL

S

TA

TE

M

ENTS

For the financial year ended 31 December 2015

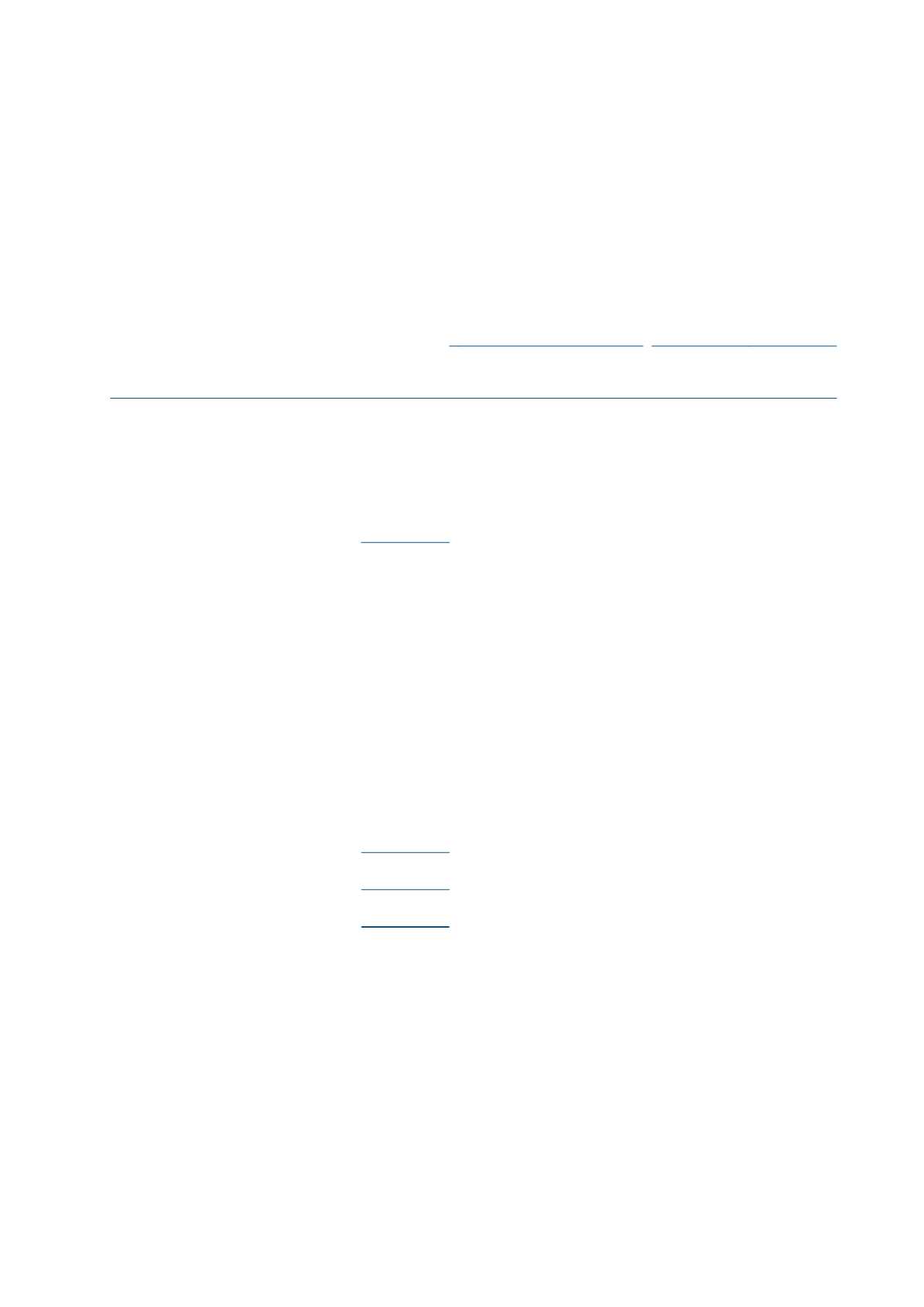

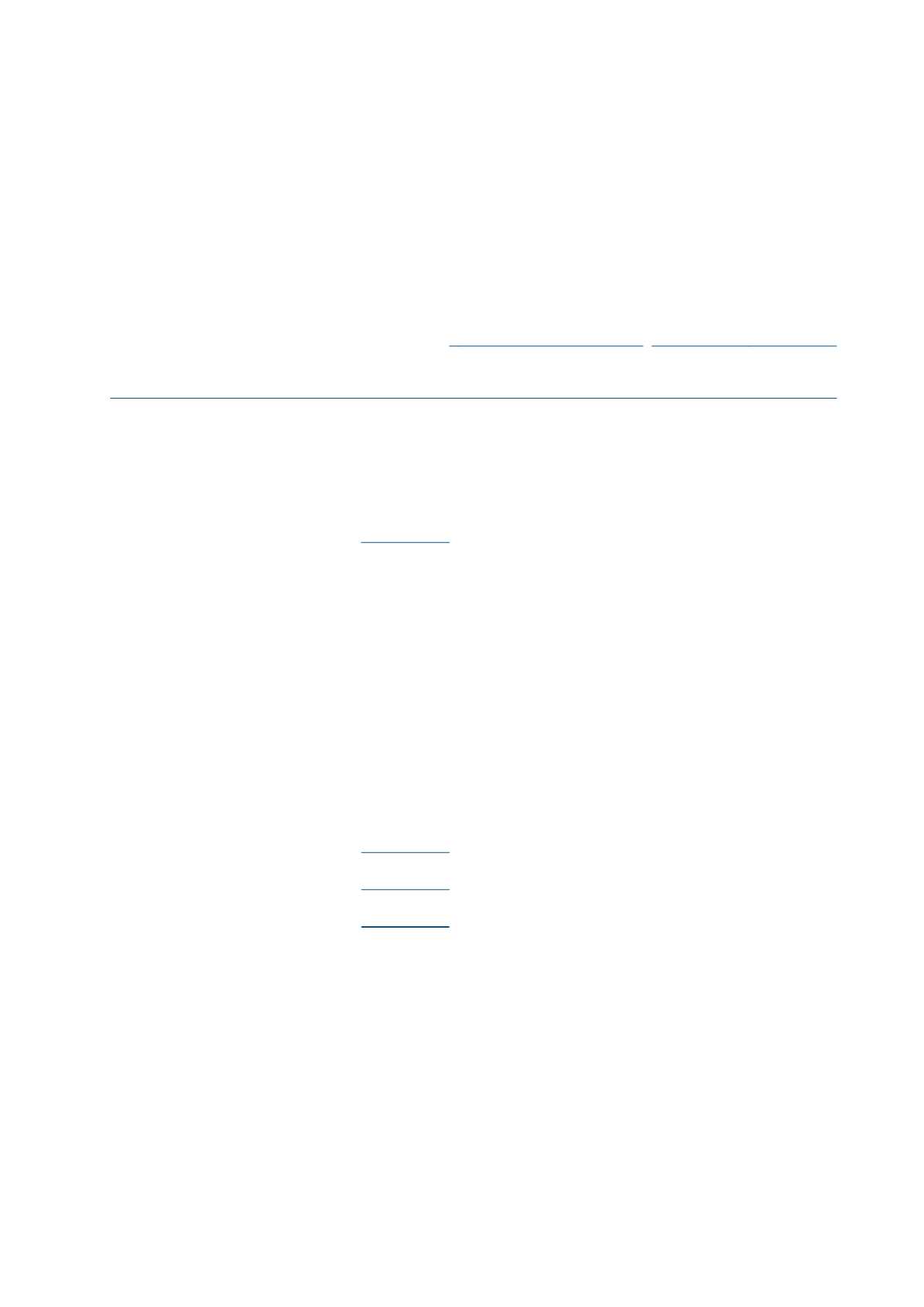

15.

GOODWILL (CONT’D)

The following key assumptions had been used:

Cash generating units

Carrying

amount of

goodwill

Pre-tax Discount Rate

Growth Rate After

Forecast Period

31

October

2015

31

October

2014

31

October

2015

31

October

2014

Recoverable amount assessment

based on value-in-use

Integrated plantation estates of

Lonsum

2,909,757

14.73% 14.54%

5.30%

5.50%

Plantation estates of PT LPI

37,230

13.61% 12.95%

5.30%

5.50%

Plantation estates of PT IBP

8,319

15.47% 14.59%

5.30%

5.50%

Plantation estates of PT SBN

234

15.20% 15.07%

5.30%

5.50%

Sub-total

2,955,540

Recoverable amount assessment

based on FVLCD

Plantation estates of PT GS

8,055

16.18% 15.67%

5.30%

5.50%

Plantation estates of PT MPI

2,395

15.66% 14.94%

5.30%

5.50%

Plantation estates of PT KGP

29,140

15.82% 15.07%

5.30%

5.50%

Integrated plantation estates of PT CNIS

7,712

15.84% 15.13%

5.30%

5.50%

Plantation estates and research facility

of PT SAIN

113,936

16.54% 15.36%

5.30%

5.50%

Plantation estates of PT RAP

3,388

15.60% 14.80%

5.30%

5.50%

Plantation estates of PT JS

1,533

15.21% 14.30%

5.30%

5.50%

Integrated plantation estates of PT MISP

34,087

16.46% 15.25%

5.30%

5.50%

Plantation estates of PT SAL

86,996

11.03%

9.76%

5.30%

5.50%

Plantation estates of PT WKL

4,750

9.27%

9.97%

5.30%

5.50%

Plantation estates of PT MLI

6,105

14.19% 12.95%

5.30%

5.50%

Sub-total

298,097

Grand total

3,253,637

The recoverable value calculation of the CGU applied a discounted cash flow model based on cash flow projections

covering a period of 10 years for plantation estates in early development stage and 5 years for established plantations.

The primary selling prices used in the cashflowmodel are projected prices of CPO, rubber, sugar and logs. The projected

prices of the CPO are based on the World Bank forecasts for the projection period. The projected prices of rubber

(RSS1 and other rubber products of the Group) over the projection period are based on the extrapolation of historical

selling prices and the forecasted price trend from the World Bank. The sugar prices used in the projection are based on

the extrapolation of historical selling prices and the forecasted price trend from the World Bank or the minimum sugar

price imposed by the Ministry of Trade of Indonesia, whichever is higher. The projected prices of logs are based on the

extrapolation of historical selling prices published by the International Tropical Timber Organization and the forecasted

price trend from the World Bank.

The cash flows beyond the projected periods are extrapolated using the estimated terminal growth rate indicated above.

The terminal growth rate used does not exceed the long-term average growth rate of the industry in countries where

the entities operate. The discount rate applied to the cash flow projections is derived from the weighted average cost of

capital of the respective CGUs.