INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

97.

N

O

T

E

S

T

O

T

H

E

F

IN

A

N

CI

AL

S

TA

TE

M

ENTS

For the financial year ended 31 December 2015

11.

INCOME TAX EXPENSE

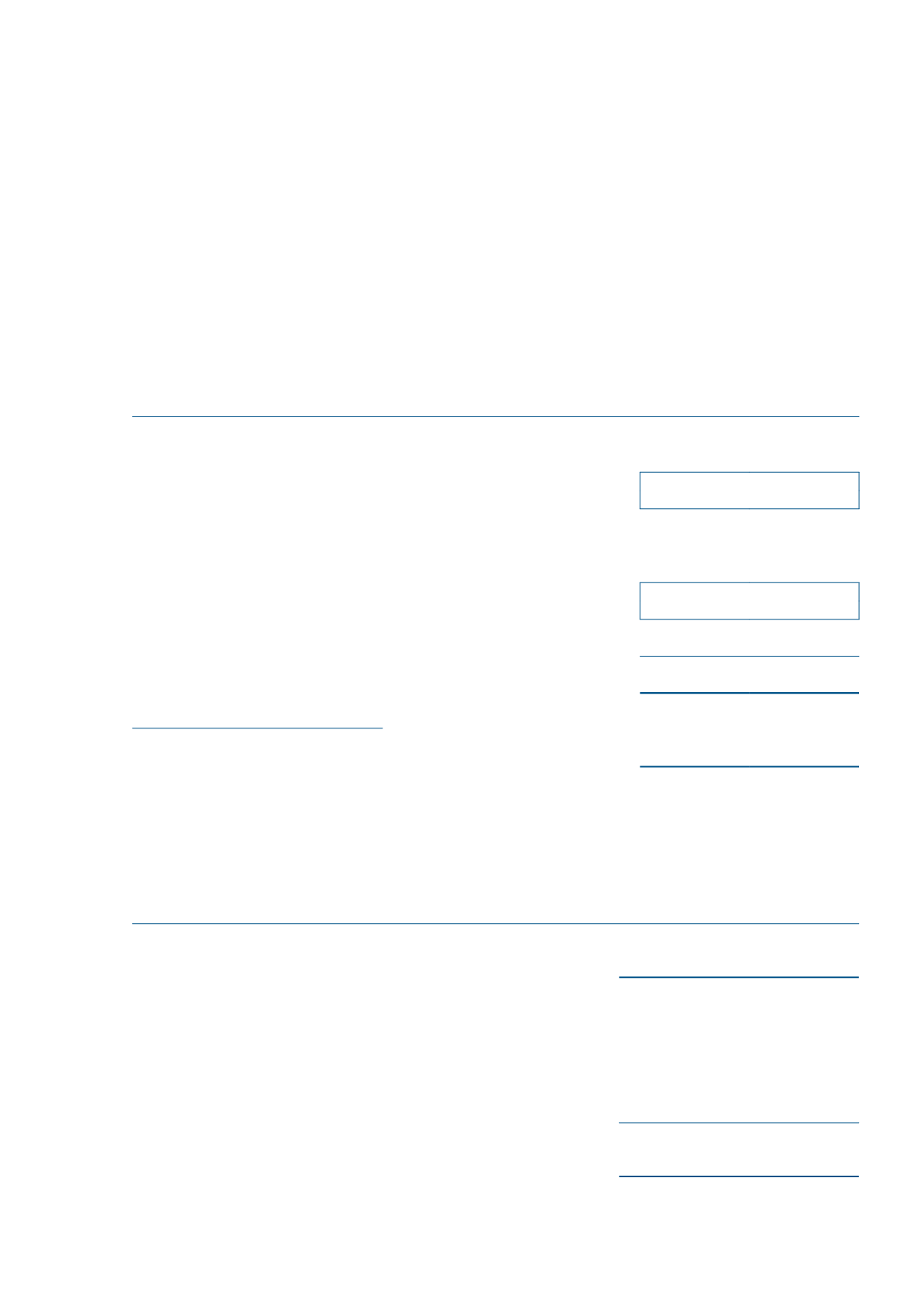

Major components of income tax expense

The major components of income tax expense for the years ended 31 December 2015 and 2014 are:

Group

2015

2014

(Restated)

Rp million

Rp million

Consolidated statement of comprehensive income:

Current income tax

- Current year income tax

528,362

814,233

- Under provision in respect of previous years

16,133

2,407

544,495

816,640

Deferred income tax (Note 17)

- Current year deferred income tax

(247,316)

(261,821)

- Under provision in respect of previous years

101,798

149,512

(145,518)

(112,309)

Total

398,977

704,331

Charged to other comprehensive income

Deferred tax related to items recognised in other comprehensive income:

Re-measurement gain/(loss) of employee benefits liability

(50,004)

4,639

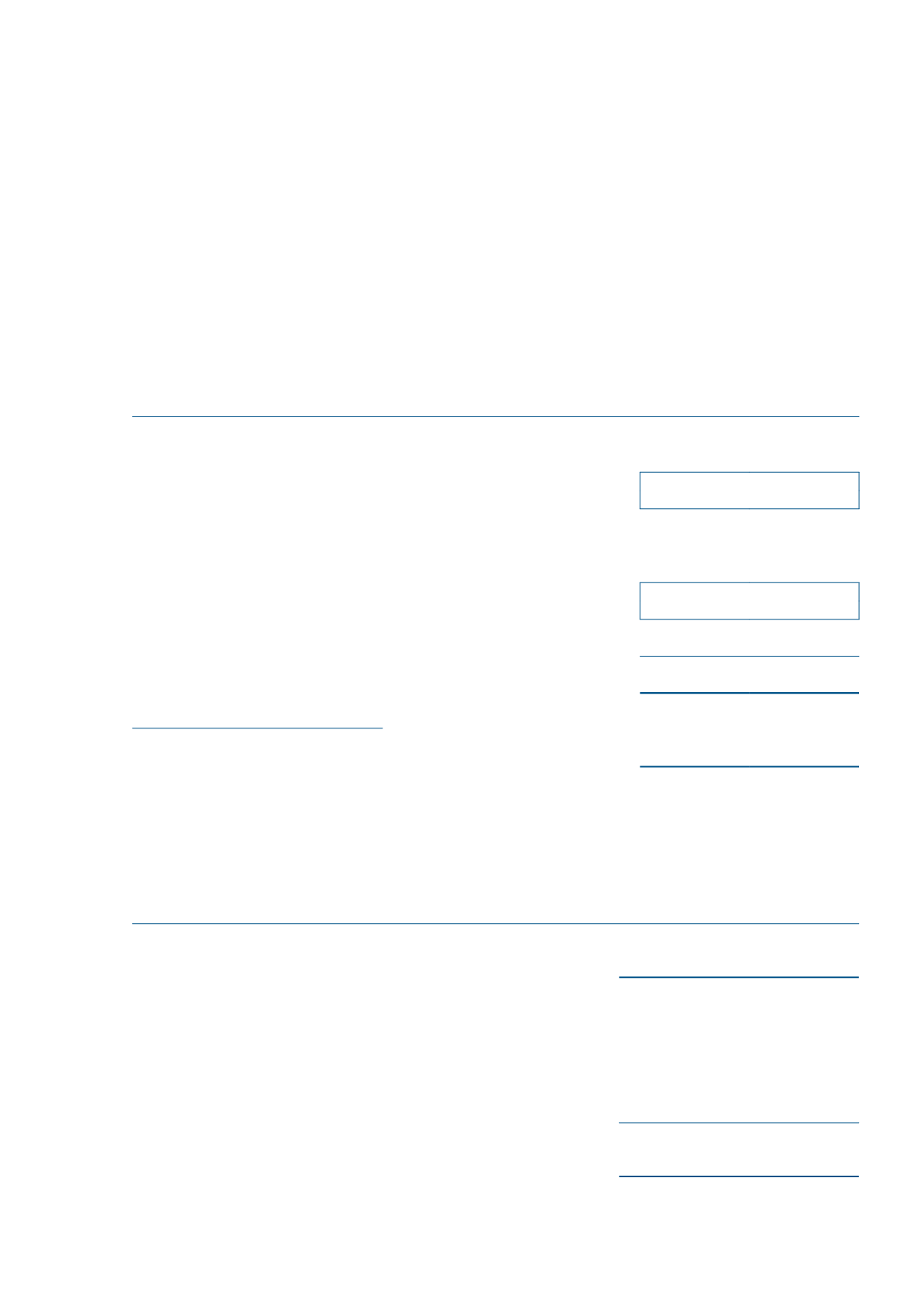

Relationship between tax expense and accounting profit

A reconciliation between tax expense and the product of accounting profit multiplied by the applicable corporate tax

rate for the years ended 31 December 2015 and 2014 is as follows:

Group

2015

2014

(Restated)

Rp million

Rp million

Profit before tax as per consolidated statement of comprehensive

income

697,751

2,032,490

Tax at the domestic rates applicable to profits in the countries where

the Group operates

251,372

523,133

Income not subject to taxation

(7,067)

(19,913)

Non-deductible expenses

82,047

116,007

Under provision in respect of corporate income tax of previous years

16,133

2,407

Under provision in respect of deferred income tax of previous years

101,798

149,512

Effect of lower tax rate

(45,306)

(66,815)

Income tax expense recognised in the consolidated statement of

comprehensive income

398,977

704,331