INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

17.

Total non-current liabilities of Rp10.0 trillion in December

2015 were 6% higher than Rp9.5 trillion in December 2014.

This was mainly due to the refinancing of certain short-

term facilities to long-term loans as explained above.

However this was partially offset by higher deferred tax

liabilities.

The Group reported negative working capital of Rp1.1

trillion in December 2015. The Group is currently in the

midst of reviewing its funding alternatives to optimise its

capital structure and current ratio.

CASH FLOWS

The Group generated lower net cash flows from operations

of Rp1.7 trillion in 2015 compared to Rp2.8 trillion in 2014.

The decline was mainly due to lower operating profit

in 2015. The Group recorded higher depreciation and

amortisation during the periods arising from additions of

fixed assets.

Net cash flows used in investing activities in 2015

was Rp3.4 trillion. This comprised principally capital

expenditure relating to additions of fixed assets, biological

assets and advances for projects of Rp2.2 trillion, and

further investment in associate companies and a JV of

Rp0.9 trillion. In 2015, no net proceeds were raised from

financing activities. As a result, Group cash levels declined

from Rp3.6 trillion in December 2014 to Rp2.0 trillion in

December 2015.

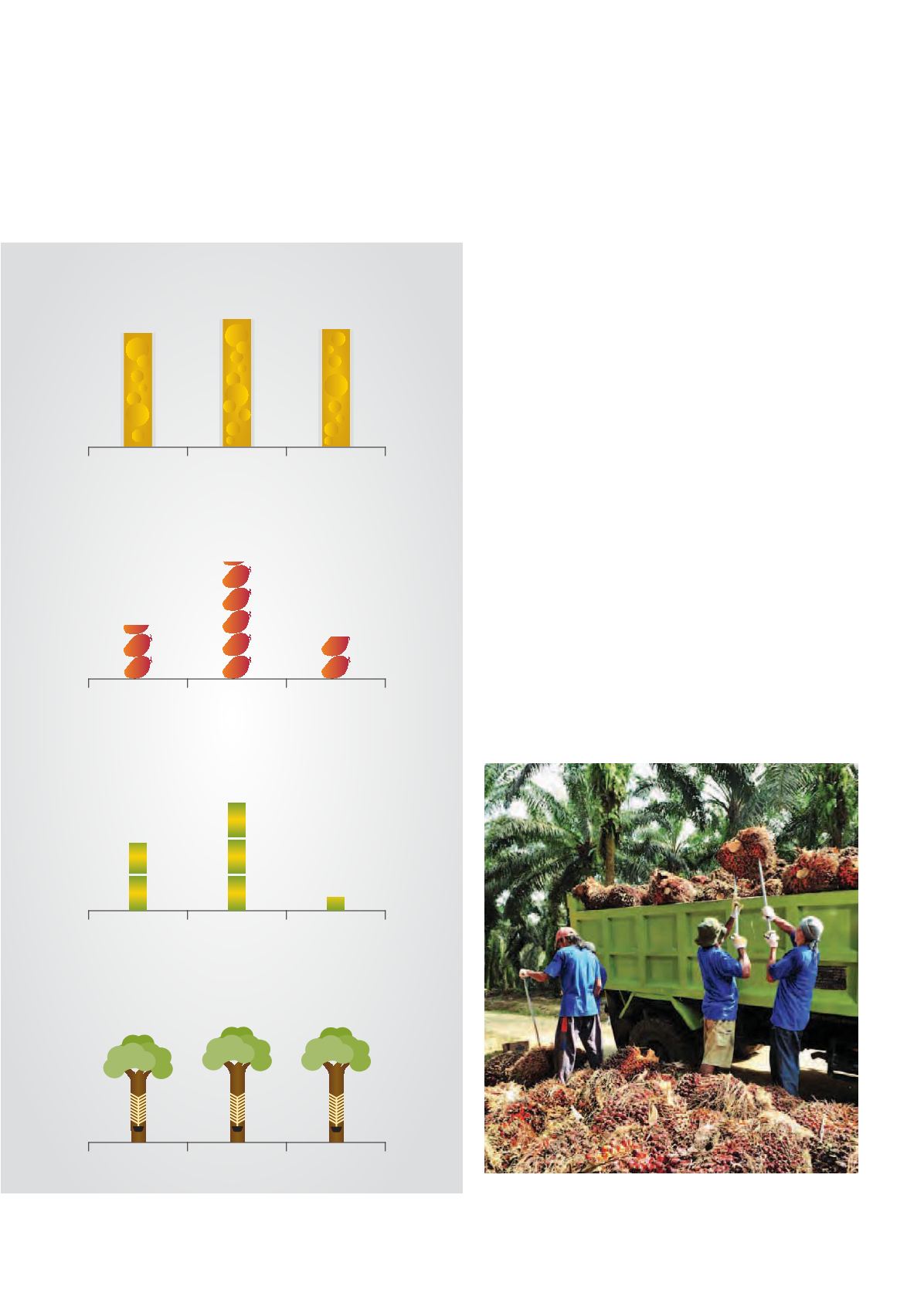

NAV per share

(Rp)

10,322

9,876

10,309

2013

2014

2015

Collection of FFB

Profit from Operations

(Rp trillion)

1.7

1.3

2.5

2013

2014

2015

Revenue

(Rp trillion)

13.8

13.3

15.0

2013

2014

2015

Net Profit to Equity Holders

(Rp trillion)

0.8

0.1

0.5

2013

2014

2015