18.

INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

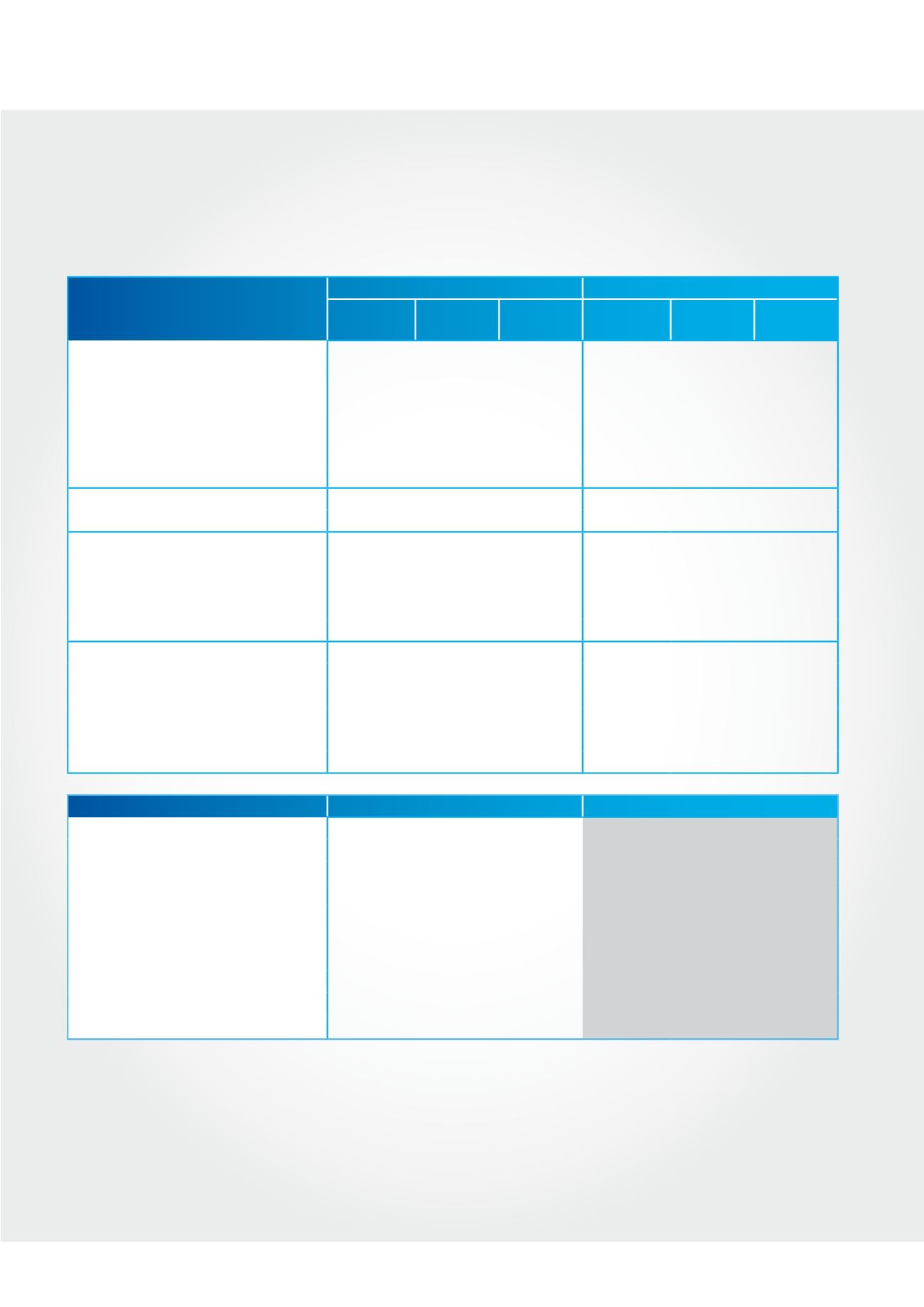

FINANCIAL HIGHLIGHTS

In Rupiah billion

In SGD million *

2013

Actual

2014

Actual

2015

Actual

2013

Actual

2014

Actual

2015

Actual

Net Sales

13,280

14,963

13,835

1,360

1,533

1,417

Gross Profit

3,204

4,368

3,350

328

447

343

Gain/(Loss) Arising from Changes in Fair

Values of Biological Assets

62

60

(20)

6

6

(2)

Operating Income

1,692

2,536

1,251

173

260

128

Net Profit

921

1,328

299

94

136

31

Attributable Profit to Equity Holders

523

759

58

54

78

6

EPS (in Rupiah)/(in SGD 'cents)

366

535

41

3.7

5.5

0.4

Current Assets

6,938

6,812

5,375

712

699

551

Fixed Assets

23,674

26,087

27,375

2,428

2,675

2,807

Other Assets

7,093

7,255

7,970

727

744

817

Total Assets

37,705

40,155

40,720

3,867

4,118

4,176

Current Liabilities

6,504

6,951

6,451

667

713

662

Non-current Liabilities

8,367

9,486

10,023

858

973

1,028

Total Liabilities

14,872

16,437

16,474

1,525

1,686

1,689

Shareholders' Equity

13,996

14,629

14,390

1,435

1,500

1,476

Total Equity

22,833

23,717

24,246

2,342

2,432

2,486

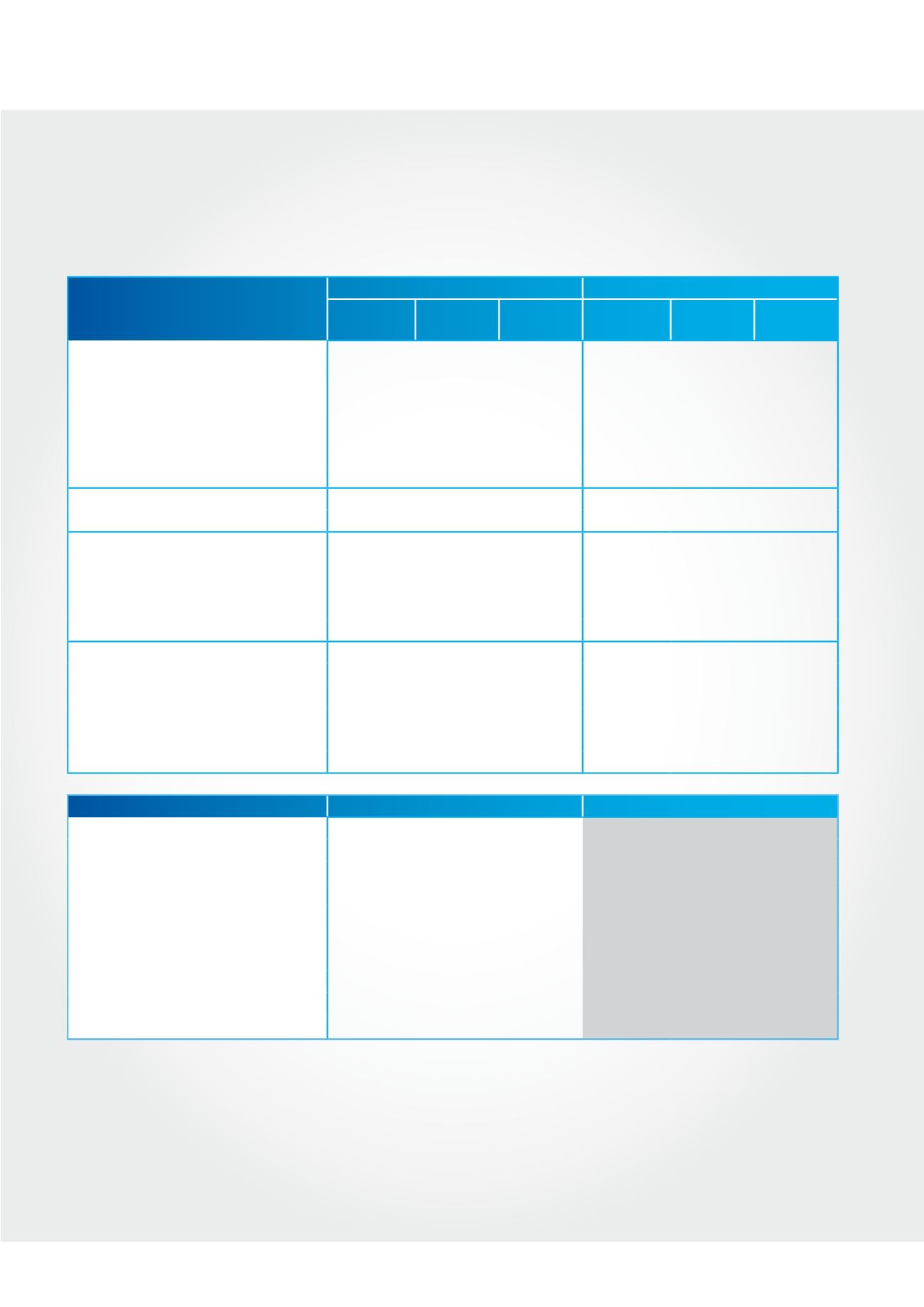

In Percentage (%)

Sales Growth

(4.1%)

12.7% (7.5%)

Gross Profit Margin

24.1% 29.2% 24.2%

Operating Profit Margin

12.7% 17.0% 9.0%

Net Profit Margin

6.9% 8.9% 2.2%

Attributable Profit to Equity Holders Margin

3.9% 5.1% 0.4%

Return on Assets

1

4.5% 6.3% 3.1%

Return on Equity

2

3.7% 5.2% 0.4%

Current Ratio (times)

1.1

1.0

0.8

Net Debt to Equity Ratio (times)

3

0.22

0.26

0.34

Total Debt to Total Assets Ratio (times)

0.23

0.24

0.25

1

Profit from operations divided by total assets

2

Net profit to equity holders divided by shareholders’ equity

3

Net debt divided by total equity

*

For ease of reference, 2013 to 2015 Income Statement and Balance Sheet items are converted at exchange rates of Rp9,763/S$1 and Rp9,751/S$1,

respectively.

GROUP PERFORMANCE

REVIEW