INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

56.

C

O

R

P

O

R

A

T

E

G

O

V

E

R

N

A

N

C

E

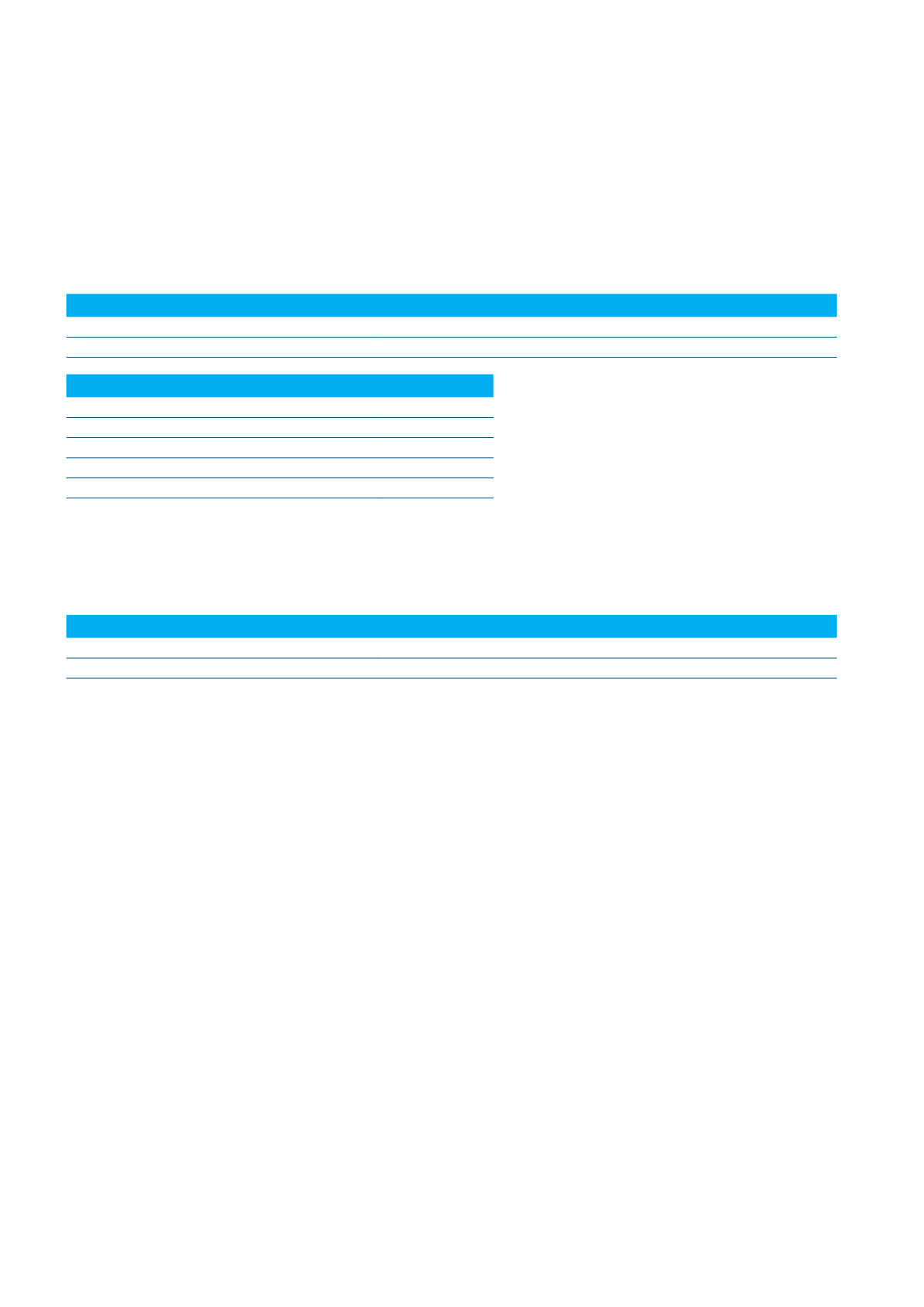

Directors’ Fees for Independent Directors

The Directors’ fees framework and the fees paid to each Independent Director are as follows:

Fees Framework (in S$)

Board

AC & RMC

NC

RC

Chairman

80,000

30,000

15,000

15,000

Members

55,000

15,000

10,000

10,000

Name of Director

Total

Lee Kwong Foo, Edward

90,000

Lim Hock San

90,000

Goh Kian Chee

90,000

Hendra Susanto

75,000

Total

345,000

Remuneration of Key Executives

The remuneration bands of Key Executives who are not also Directors of the Company are similarly disclosed in bands of

S$250,000. The total aggregate remuneration paid to the top five key management personnel (who are not Directors or the

CEO) for the financial year ended 31 December 2015 was S$1,799,574.

Remuneration Band

Number of Executives

S$250,000 – S$500,000

5

S$500,000 – S$750,000

3

Remuneration of employees who are immediate family members of a Director or the CEO

There was no employee of the Company and its subsidiaries who was an immediate family member of a Director or the CEO

whose remuneration exceeded S$50,000 during the financial year ended 31 December 2015.

Other Remuneration Matters

The Company has no share option scheme.

ACCOUNTABILITY AND AUDIT

ACCOUNTABILITY [PRINCIPLE 10]

The Board is accountable to the shareholders and is mindful of its obligations to furnish timely information and to ensure

full disclosure of material information to shareholders in compliance with legislative and regulatory requirements, including

statutory requirements and the requirements under the Listing Manual of the SGX-ST.

RISK MANAGEMENT AND INTERNAL CONTROLS [PRINCIPLE 11]

The AC & RMC, with support from the internal and external auditors as well as the Enterprise Risk Management (“

ERM

”) team,

reviews and reports to the Board regularly on the effectiveness and adequacy of the internal control system. These reports

cover operational, financial and compliance controls, risk management policies and systems. The AC & RMC meets with

internal and external auditors at least four times a year and at least one of these meetings is conducted without the presence

of Management. The AC & RMC also meets with the ERM team separately at least four times a year.

The ERM team communicates and coordinates with the Internal Audit Department (“

IAD

”) to focus on high risk areas, ensure

accuracy of risk assessment reports and implement the risk mitigation strategies and controls effectively. The IAD also

performs independent reviews of the risks and controls identified by the ERM team to ensure adequate monitoring and proper

resolution.