INDOFOOD AGRI RESOURCES LTD

ANNUAL REPORT 2015

50.

C

O

R

P

O

R

A

T

E

G

O

V

E

R

N

A

N

C

E

The Board and Management of Indofood Agri Resources Ltd. (the “

Company

” and together with its subsidiaries, the “

Group

”)

firmly believe that good corporate governance is critical to the sustainability and long-term success of the Company’s

businesses and performance. We are committed to continuously enhance the standards of corporate governance principles

and processes so as to improve performance, accountability and transparency of the Company.

This report sets out the key aspects of the Company’s corporate governance framework and practices, with specific reference

to the principles and guidelines of the Code of Corporate Governance 2012 (“

2012 Code

”). The Company has complied with the

principles and guidelines of the 2012 Code, with exception to Guidelines 4.4, 8.4, 9.2 and 9.3.

For Guideline 4.4, the Nominating Committee (“

NC

”) has reviewed the participation and contribution of the Directors, as well

as the number of meetings attended by the Directors in 2015. The NC is satisfied that the Directors with multiple board

representations have been able to devote sufficient time to the affairs of the Company to adequately discharge their duties as

Directors and continue to provide objective views to the Board and Management. As such, the Board does not stipulate a policy

for the maximum number of listed company board representations a Director may hold.

For Guideline 8.4, the Company does not stipulate a policy for the reclamation of variable incentives. However, the Remuneration

Committee (“

RC

”) has the discretion not to award or reclaim the variable incentives from Executive Directors and key

management personnel in exceptional circumstances involving material misstatement of financial results or misconduct

resulting in financial loss to the Company.

As for Guideline 9.2 and 9.3, the Board and Management are not in favour of disclosing the exact remuneration of its Directors

and the CEO, and the salary band for each key executive with a breakdown (in percentage or dollar terms) of the remuneration

earned. This is in consideration of the competitive environment, the nature of the industry and the confidentiality of such

information, as this may adversely affect our ability to attract and retain talent.

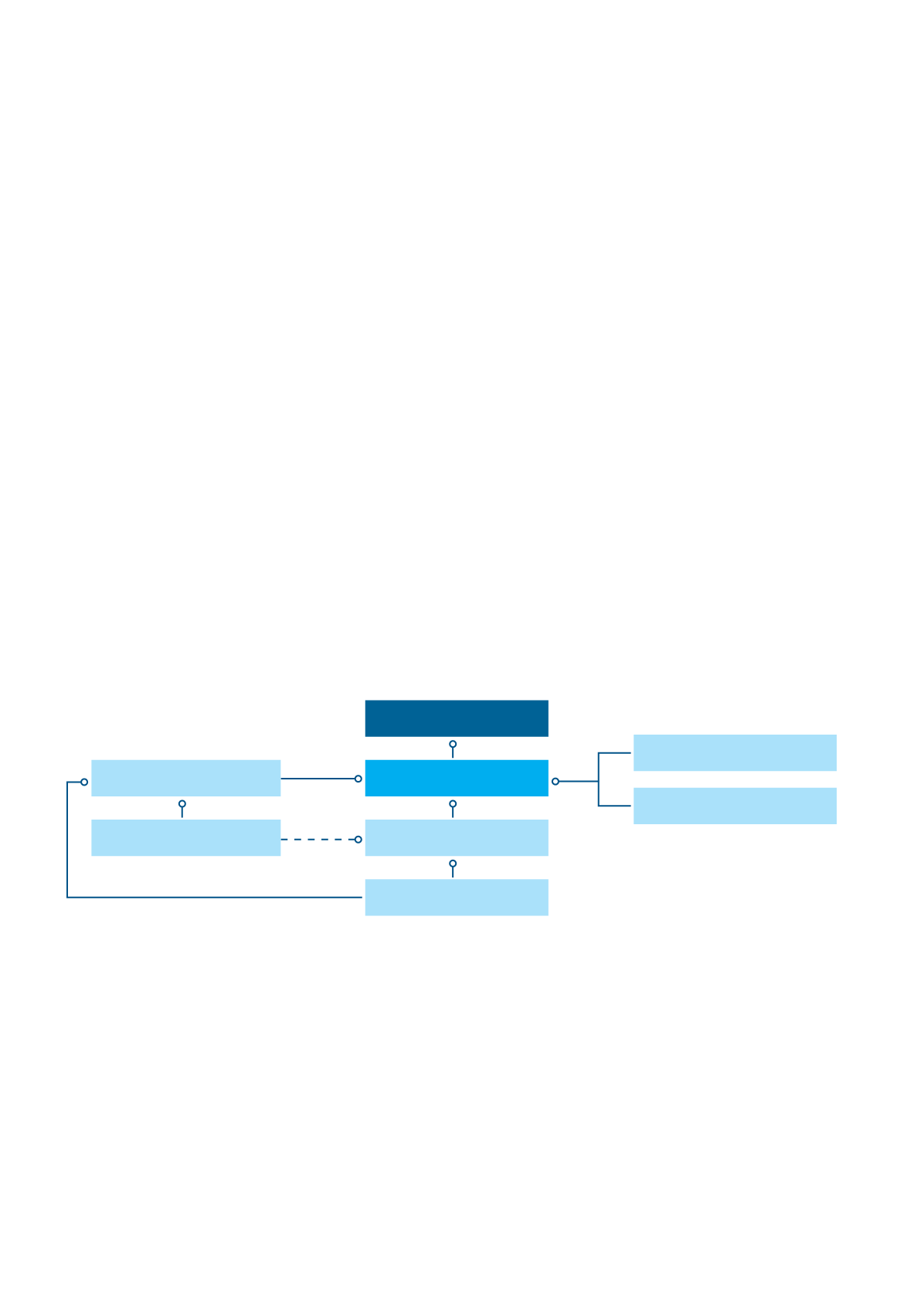

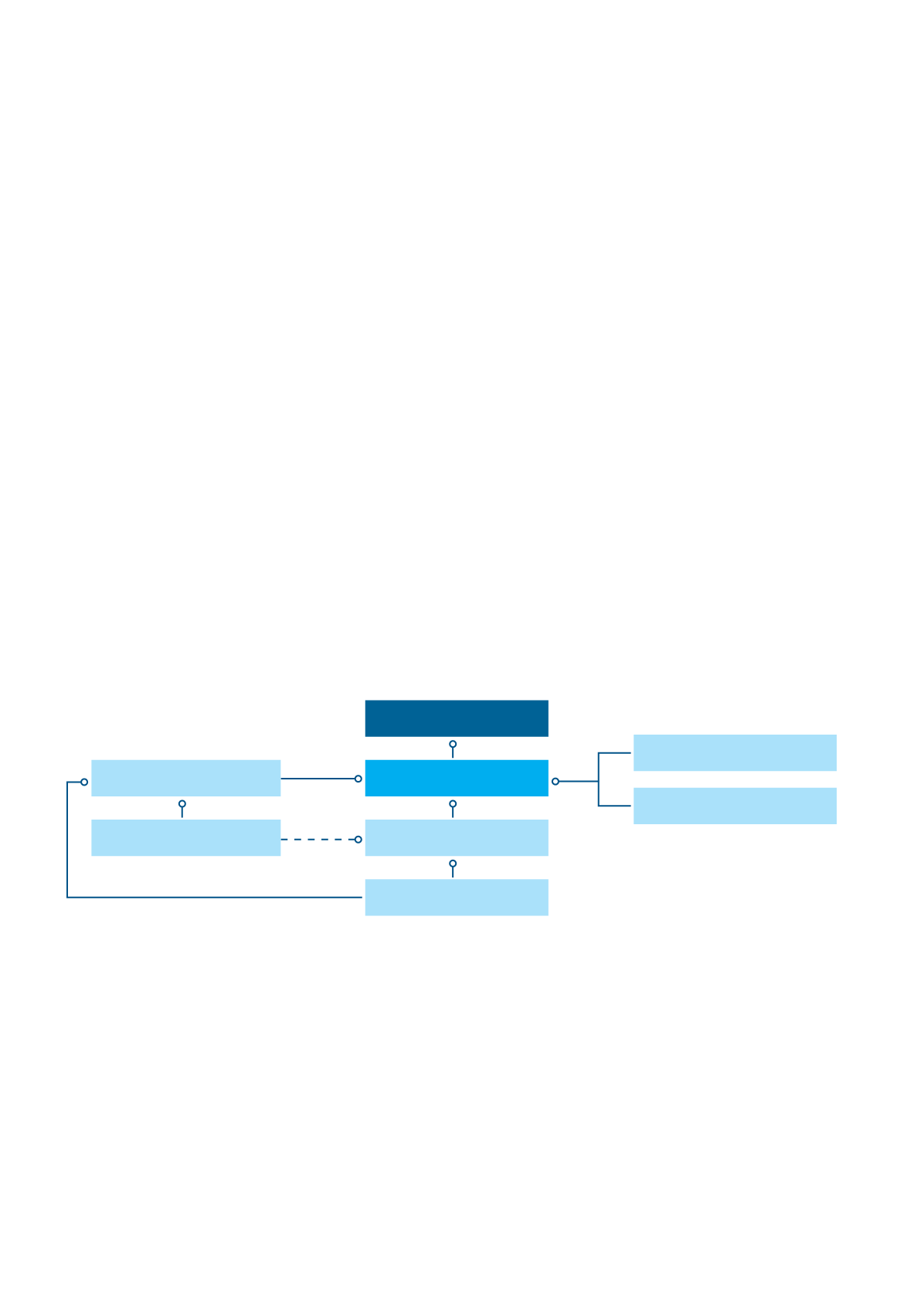

Our Corporate Governance Structure is as follows:

BOARD MATTERS

BOARD’S CONDUCT OF ITS AFFAIRS [PRINCIPLE 1]

The Board of Directors (the “

Board

”) comprises of Directors with a wide range of skills and experience in the fields of operations

management, banking, finance, accounting, risk management, and industry knowledge. The Board considers that its Directors

possess the necessary competencies to lead and govern the Company effectively. A brief biography of each Director is given on

pages 46 to 48 of this Annual Report.

Roles and Responsibilities of the Board

The principal functions of the Board are to:

•

review the financial performance and condition of the Group;

•

approve the Group’s strategic plans, key operational initiatives, major investment, divestment and corporate restructuring,

as well as major funding decisions;

•

identify principal risks of the Group’s businesses, and implement systems to manage these risks;

•

assume the responsibility of corporate governance;

•

establish and maintain exemplary values and standards for the Company; and

•

ensure all statutory obligations to shareholders and other stakeholders are understood and met.

SHAREHOLDERS

BOARD OF DIRECTORS

EXECUTIVE COMMITTEE

ENTERPRISE RISK

MANAGEMENT

AUDIT AND RISK

MANAGEMENT COMMITTEE

INTERNAL AUDIT

REMUNERATION

COMMITTEE

NOMINATING COMMITTEE